AAIS THEATRICAL PROPERTY COVERAGE ANALYSIS

(August 2018)

|

|

INTRODUCTION

The American Association of Insurance Services (AAIS) Theatrical Property Coverage insures property that is used in staging a theatrical production. The scenery, costumes, and other theatrical property are covered when designed to be used in such a production. The coverage is meant for traveling companies is not restricted to specific locations.

ELIGIBILITY

Any theatrical production or play is eligible.

Carnivals, circuses, and rodeos are not eligible productions. Costume rental companies and theatrical suppliers also cannot purchase this coverage.

|

|

POLICY CONSTRUCTION

AAIS Theatrical Property coverage requires at least these four forms:

- IM 7900–Inland Marine–Declarations

- CL 0100–Common Policy Conditions

Related Article: CL 0100 AAIS Commercial Lines Common Policy Conditions

- IM 1505–Schedule of Coverages–Theatrical Property

- IM 1500–Theatrical Property Coverage

IM 1505–SCHEDULE OF COVERAGES–THEATRICAL PROPERTY

This Schedule of Coverages is used with IM 1500–Theatrical Property Coverage. It contains the following information:

Schedule of Productions

The item number, the description of the production, and the limit of insurance that applies to the described production are entered in the spaces provided.

Deductible

The deductible amount the named insured retains for each covered loss must be entered in the space provided.

Optional Coverages

Breakage, Marring, Scratching, or Exposure to Light is excluded under the policy. To remove the exclusion, a checkmark must be placed in this area.

Rates and Premium

This coverage is written on a non-reporting basis. This section has spaces to enter the annual premium, the non-reporting rate per $100, and any minimum premium that applies.

IM 1500–THEATRICAL PROPERTY COVERAGE ANALYSIS

This analysis is of the 09

05 edition. The single change from the 01 05 edition is in bold print.

Agreement

This section states that the insurance company provides the coverage

described in return for the named insured paying the required premium. This

agreement is subject to all the coverage form’s terms, the schedule of

coverages, and any additional conditions that apply. Endorsements or additional

schedules identified on the schedule of coverages also apply.

A statement that certain words and phrases identified in bold print in

the coverage form are defined in the Definitions section that is immediately

following this Agreement.

Note: There is no clearly marked space on the schedule of coverages

to list endorsements or additional schedules that apply at inception.

Definitions

Defined words are used throughout the coverage form. When these terms are used in the coverage form, the meaning provided in this section must be applied. Nine terms are defined:

1. You and your

The parties that are

specifically named on the declarations as insureds.

2. We, us, and our

The insurance company that is

providing the coverage.

3. Limit

The amount of coverage that applies.

Note: There is no reference as to what it applies; it just applies.

4. Pollutant

This is a broad and expansive term. It is solids, liquids,

thermal or radioactive contaminants, and irritants. It includes, but is not

limited to, acids, alkalis, chemicals, fumes, smoke, soot, vapor, and waste.

Waste includes materials intended for recycling, reclamation, and reconditioning,

as well as for disposal. Visible and invisible electrical or magnetic emissions

and sound emissions are also considered pollutants.

5. Schedule of

coverages

Any

page labeled as such that contains coverage information, including declarations

or supplemental declarations.

6. Sinkhole collapse

The

earth’s surface suddenly settling or collapsing into an underground opening

that was created by water acting on limestone or some other rock

formation. Sinkhole collapse does not include either the land’s value or the

cost to fill sinkholes.

7. Specified perils

The

named perils of aircraft, civil commotion, explosion, falling objects, fire,

hail, fire extinguishing equipment leakage, lightning, riot, sinkhole collapse,

smoke, sonic boom, vandalism, vehicles, volcanic action, water damage,

the weight of sleet, snow or ice and windstorm. Two terms need

further explanation.

Falling

objects does not include loss to personal property stored in the

open. It also does not include damage to the interior of buildings or personal

property stored in buildings unless a falling object first breaches the

building's exterior.

Water

damage is the sudden or accidental discharge or leakage of water or

steam. However, it must be a direct result of a part of the system or

appliance that holds the water or steam cracking or breaking.

8. Terms

These are all provisions, limitations, exclusions, conditions, and

definitions that apply to this coverage.

9. Volcanic action

An

airborne volcanic blast or shock wave. It is also ash, dust, and

particulate matter along with any lava flow. The term does not include the cost

of removing dust, ash, or particulate matter from

the covered property unless there is direct physical damage to the

property.

|

|

|

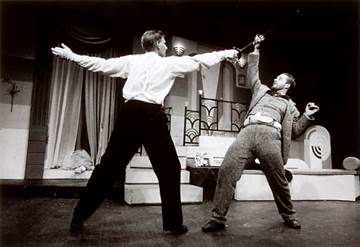

Example of theatrical property |

Property Covered

The insurance company covers property that is described below unless it is excluded or subject to limitations.

Theatrical Property

1. Coverage

Direct physical loss to the named insured's covered property is covered when it is the result of a covered peril. Covered property is only theatrical property. Examples of such property are costumes and scenery, but it is not limited to only those items. Theatrical property of others that is in the named insured's care, custody, or control is also covered property.

2. Coverage Limitation

The theatrical property covered is limited to that being used in the production or productions listed on the schedule of coverages.

|

Example: The Melancholy Players have been performing for more than ten years. It has most of the props, costumes, scenery, and other property that it has used over those years just in case something may be useful for a new production. A fire destroys all of Melancholy’s property. However, only the property that was part of any of the productions listed on the schedule of coverages is covered. |

Property Not Covered

There is no coverage for the following property:

1. Animals

There are no exceptions to this item and no definition of animals is provided.

2. Buildings and

Improvements

The coverage provided by this form is for only theatrical property used in a production. There is no coverage for any building the troupe may own. There is also no coverage for any improvement made to a building even if done to assist a production because there is no exception.

|

|

3. Contraband

Property that is illegal to possess is not covered. Property that is legal

to possess but that is being used as part of an illegal trade or that

is being transported illegally is also not covered.

4. Furniture,

Fixtures, and Other Property

None of these items are

covered. There is an exception. If any are used in a described production, they are covered.

|

Example: Melancholy Players are doing a revival of

His Girl Friday and an important

scene requires a substantial roll top desk along with other desks and chairs as props that create a

newspaper room. These items are covered because they are part of the

production. |

5. Jewelry

Jewelry and watches are not covered. Other items that consist of

precious or semi-precious stones or gold, silver or platinum are not covered.

Note: The policy does not specifically state that

jewelry and watches that are NOT made of stones or precious metals are covered

so this would mean that costume jewelry is also not covered. The wording is confusing

that could lead to an ambiguity to the benefit of the named insured.

6. Money and

Securities

Currency, accounts, bills, food stamps

and other evidence of debt are not

covered. Transportation and admission tickets, money, notes, or securities are

also not covered.

Note: This property is more correctly insured under

commercial crime coverage forms.

Related Article: Commercial Crime Coverage Analysis

7. Valuable Papers

Valuable papers and, specifically, deeds are not covered.

8. Vehicles

Only motor vehicles that are licensed to be used on roads or highways or

that are actually used on roads or highways are not covered. There is an

exception. An unlicensed motor vehicle that is used as scenery or stage

property in a production listed on the schedule of coverages is covered.

Note: Property excluded is noteworthy and unique relative to the class of business and other property covered. For example, most property policies exclude motor vehicles but the exception, in this case, permits narrow coverage for them if they are part of the production. Even though circuses and rodeos are not eligible for coverage, this coverage form excludes animals in case a production happens to have animals as part of it. Live animal coverage is available under separate coverage forms and policies.

|

Rodeos are

not eligible for Theatrical Property Coverage. |

Optional Coverage

This optional coverage applies only if there is an entry for it on the schedule of coverages.

Breakage, Marring,

Scratching, Exposure to Light

This is used to remove exclusion 2.c.

Loss caused by any of the following perils damaging covered property will be paid:

· Glass, tubes, bulbs, lamps, or glass articles breaking

· Marring or scratching

· Exposure to light

Perils Covered

Coverage applies to risks of direct physical loss unless the loss is limited, or an excluded peril causes the loss.

Other Coverages–Collapse

1. Coverage

Loss

to covered property when caused by a direct physical loss that involves collapse of a building or structure, or any part of a building or structure containing covered property.2. Covered Perils

The only collapse coverage provided is collapse caused by one of more of the following:

- One of the specified perils or

breakage of building glass, to the extent that this coverage form insures those perils

- Hidden

decay. This does not apply if the named insured was aware of the

decay before the collapse

- Hidden insect or

vermin damage. This does not apply if the named insured was aware of

the damage before the collapse

- Weight of people or personal property. There is no statement as

to where the people or personal property must be.

- Weight of rain. This is limited to only that rain

that collects on a roof.

- Using defective

materials or methods of construction, remodeling, or renovation. This

applies only if the collapse occurs during any of these operations.

- If the collapse occurs

after construction, remodeling, or renovation are complete and defective

materials or methods of construction, remodeling or renovation

is partially to blame, coverage applies if any of the

other contributed to the loss.

3. Collapse Means

Collapse is the sudden and unexpected falling in or caving in of a

building or structure (or any part of it) that prevents the building

from being occupied for its intended purpose.

4. Collapse Does Not

Mean

The following buildings and structures are not considered to be

in a state of collapse:

- One that is still

standing or any portion of it that is still standing. This applies

even when there is evidence of bending, bulging, cracking, expanding,

leaning, sagging, settling, or shrinking.

- One in danger of

falling in or caving in

- When a portion is

still standing even though it is separated from another portion of the

building or structure

5. Coverage

Limitation

This coverage does not provide any increase in the limit for covered property.

|

Example: Melancholy Players are scheduled to perform at Perilous Towers. They are concerned because of the creaky sounds in the building but they are assured that the building has passed all inspections and is sturdy. All their property is moved in and rehearsal has started. During the night part of the roof comes crashing down and destroys all of Melancholy’s property. The loss is covered because the collapse was abrupt and due to hidden decay of which the named insured was not aware. |

Perils Excluded

1. Primary Exclusions

The

first group of exclusions is essentially absolute. Subject to specific

exceptions, loss or damage by each is totally excluded, regardless of any

other cause or event that contributes to a loss, either concurrently or in any

other sequence. The insurance company does not pay for any direct or indirect

loss or damage caused by or that results from any of these events.

a. Civil Authority

There is no

coverage for loss that results from an order any civil or government

authority issues. These orders may include seizure, confiscation,

destruction, or quarantine of property but this exclusion is not limited to

only these. The only exception is when a civil authority destroying property as

a means of controlling a fire causes the loss or damage. This exception applies

only if the fire is the result of a covered peril.

b. Nuclear

Hazard

The insurance

company does not insure against loss or damage from any nuclear reaction,

radiation, or contamination, whether the nuclear incident was controlled or not,

or was caused by any means. Any loss caused by the nuclear hazard is not

treated as a loss caused by fire, explosion, or smoke. However, coverage applies to direct loss or

damage caused by fire that results from the nuclear hazard.

c. War and

Military Action

The insurance

company does not pay for loss or damage caused by any act of war. Undeclared

and civil war or warlike action by a military force are all

considered war. All actions taken to hinder or defend against an actual or

expected attack by any government or sovereign authority that uses military

personnel or other agents are also considered war and excluded. In

addition, acts of insurrection, rebellion, revolution, or unlawful seizure of

power and any action any government authority takes to prevent or defend

against any such acts are excluded. If any action within the terms

of this exclusion involves nuclear reaction, radiation, or contamination, this

exclusion applies in place of the nuclear hazard exclusion. (09 05 addition)

Note: This means that the

exception for resulting fire under the nuclear hazard is not

covered when it is the result of war.

2. Secondary

Exclusions

The second

group of exclusions applies to loss or damage caused by or that

results from any of the following loss events. Some of these exclusions

have exceptions, conditions, or limitations that should be noted and

reviewed carefully. The insurance company does not pay for any loss or damage

caused by or that results from any of these events.

a. Acts or Decisions

There is no coverage for loss caused by or that results from any acts or

decisions by any person, organization, or government entity. This also includes

failing to act or decide.

This exclusion has an exception. The act

or decision, or the failure to act or decide, may result in a covered

peril. In that case, the loss or damage that peril causes is covered.

b. Animal Nesting, Infestation, or Discharge

Coverage does not apply to loss or damage when it is due to nesting,

infestation, discharge, or release of waste products or secretions by animals.

The term animal includes birds, insects, and

vermin but is not limited to only these.

This exclusion has an exception. If any of these excluded events results

in a covered peril, the loss or damage that peril causes is covered.

|

Example: The Kensington Players present a summer

outdoor program. The way the backdrop was built one year caused it to become

a happy hive. The players were dismayed when bees began to swarm, and honey

was dripping down the walls. The backdrop had to be destroyed and rebuilt. There

is no coverage because of this exclusion. |

c. Breakage, Marring, Scratching, or Exposure to Light

Loss or damage that is caused by the breaking of glass objects or items made mostly of glass is excluded. When loss or damage is caused by property being marred, scratched, or exposed to light there is also no coverage.

This exclusion has three exceptions.

- Breakage of lenses is not excluded.

- If any of the excluded events result in a specified peril, theft, or attempted theft, the loss these perils cause is covered.

- Covered property damaged by one or more of these events is not excluded when it is in a carrier for hire’s custody.

|

Example: Melancholy’s current production

is Guess Who’s Coming to Dinner. It

requires a well-set table with lovely china and crystal. These items are

carefully packed but when they are unloaded a cast member, who was moving too

quickly. tripped over the open crate resulting in half of the items being

smashed. Because of this exclusion, no coverage applies. However, if the

Breakage, Marring, Scratching or Exposure to Light optional coverage had been

purchased, coverage would apply. |

|

|

d. Collapse

Loss caused by collapse is excluded.

This exclusion has two exceptions.

- The collapse coverage provided in Other

Coverages- Collapse

- When an excluded collapse results in a

covered peril occurring, coverage applies to the loss or damage that

covered peril caused.

e. Contamination or Deterioration

Loss or damage that is caused by contamination or deterioration is excluded. This applies to corrosion, decay, fungus, mildew, mold, rot, and rust. It also applies to any quality, fault, or weakness in covered property that causes it to damage or destroy itself. However, this exclusion is not limited to only these described causes. This exclusion has an exception. When contamination or deterioration results in a covered peril, the loss or damage that covered peril causes is covered.

f. Criminal, Fraudulent, Dishonest, or Illegal Acts

Coverage does not apply to loss caused by or that results from criminal, fraudulent, dishonest, or illegal acts, committed by any of the following alone or in collusion with another:

- The named insured

- Others with an interest in the property

- Others to whom the property has been entrusted

- The named insured's partners, officers, directors, trustees, joint venturers, members, or managers, as applicable, based on the named insured’s type of business organization

- Employees of any of the groups listed above. Employees are excluded even if the act occurs when they are not considered to be working.

Coverage applies if employees destroy property. It does not apply if employees steal.

This exclusion does not apply to covered property in the custody of a carrier for hire.

g. Electrical Currents

There is no coverage for loss or damage that is due to artificially

generated electrical currents damaging electrical apparatus or wiring that is

inside the insured property. This exclusion applies only to the property that

artificially generated the current.

This exclusion has an exception. Electrical currents may result in a

fire or explosion. In that case, the loss or damage the fire or explosion

causes is covered.

h. Fault,

Defect, or Error

Loss or damage that is

due to errors, faults or defects in planning, zoning, surveying, site plans, grading, compacting, land use, or

development is not covered. Loss or damage due to property related design,

blueprint, specification, workmanship, building, maintaining, installing,

renovating, remodeling, or the repairing errors, faults or defects are also

excluded.

An important provision is that this exclusion applies both on and away from the designated premises and applies regardless of negligence.

This exclusion has an exception. One of these events may result in a covered peril. In that case, the loss or damage that peril causes is covered.

i.

Loss of Use

There is no coverage for loss that is the result of delay, loss of use, or loss of market.

j. Mechanical Breakdown

Loss that is due to mechanical breakdown is excluded. The only exception is that when such an

excluded loss causes a covered peril then the resulting loss from that covered

peril is covered.

k. Missing Property

The unexplained or mysterious disappearance of covered property is

excluded when there is no physical evidence to suggest what

happened to it and the only proof that a loss occurred is based on an audit or physical inventory. This exclusion has an exception. It does not apply

to covered property that is in the custody of carriers for hire.

|

Example: Melancholy’s prop master is beside himself. The elaborate centerpiece for the dinner table is missing. It does not belong to the company and he cannot imagine who might have taken it. There are no obvious signs to indicate it was stolen. He knows it was in the room when he locked up the night before, but it was not there when he opened the door in the morning. Because there is no proof that a covered peril occurred, there is no coverage. |

l. Pollutants

There

is no coverage for loss caused by or that results from any release, discharge,

seepage, migration, dispersal, or escape of pollutants. There are two exceptions:

- A specified peril

causes the event

- When a pollutant

release results in a specified peril, the resulting loss from that

specified peril to covered property is covered.

m. Process

to Repair, Adjust, Service, or Maintain

When loss or damage is the result of a repair to, adjustment of, service

of, or maintenance of covered property is excluded.

This exclusion has an exception. If any of the above actions result in a

fire or explosion the loss or damage from the fire or explosion is covered.

n. Temperature or Humidity

Coverage is not provided when dryness, dampness, humidity, or changes

and extremes of temperature cause or result in loss or damage to covered

property.

This exclusion has an exception. If any of the above result in a covered

peril the loss or damage from that peril is covered.

o. Theft from an Unattended Vehicle

Coverage does not apply to theft of

covered property from an unattended vehicle unless the vehicle was locked, its

windows securely closed, and there was visible evidence of forced entry into the

vehicle.

This

exclusion has an exception. It does not apply to covered property in the

custody of carriers for hire.

|

|

Example: Melancholy

is excited about its upcoming production of Cats. It is the most elaborate production they have attempted. It

is using Props and Things, a carrier for hire, to transport most of the large

set pieces. When items are stolen from one of the trucks, coverage applies

even though it was unattended and unlocked at the time of the theft. |

p. Unauthorized

Instructions

Coverage does not apply if a loss occurs because property was given to another person or sent to another place based on unauthorized instructions.

|

Example: Props and Things receives a call supposedly from Melancholy’s prop master and is told that the production has been moved to a different city. Props and Things deliver the props to the person who opens the door at the theater. A day later Melancholy’s real prop master calls Props and Things furious because the items had not yet been delivered. He is upset when he learns about the items being delivered to another theater and that the items have totally disappeared. He is even more upset when he discovers that there is no coverage under the policy for items that had been given to others based on unauthorized instructions. |

q. Voluntary Parting

There is no coverage for loss to covered property

voluntarily given to others, even if the surrender was due to a fraudulent

scheme, trick, or false pretense.

r.

Wear and Tear

Loss or damage caused by wear and tear is excluded.

This exclusion has an

exception. Wear and tear may result in a covered peril. In that case, the loss

or damage that peril causes is covered.

s. Weather

This exclusion has an exception. The weather conditions may result in a covered peril. In that case, the loss that peril causes is covered.

What Must Be Done In Case Of Loss

1. Notice

The named insured must give prompt notice of a loss to the insurance company or its agent. The notice must include a description of the property lost or damaged. If a criminal act caused the loss, the appropriate law enforcement agency must also be notified. The insurance company has the right to require that any notice to it be in writing.

2. You Must Protect

Property

During and after a loss, the named insured must take all reasonable steps to protect covered property from further loss. The insurance company pays reasonable costs the named insured incurs to do so if the named insured maintains accurate records to substantiate the costs. Paying these costs is not in addition to the policy limits. There is no coverage for any repairs or emergency measures performed on property not already damaged by a covered peril.

Note: It is important to realize that any such costs incurred will reduce the amount available to pay the actual loss.

3. Proof of Loss

The named insured must complete and return the insurance company's prescribed proof of loss forms within 60 days after the company requests it. The information provided must include the time, place, and circumstances involved with the loss and information on any other insurance coverage that may apply. It must also include the named insured’s interest and the interest of others with respect to the property involved, including liens, and mortgage. Any changes in the title to the property during the policy period must be disclosed, in addition to providing any other reasonable information including inventories, specification and estimates the company may require in settling the loss.

4. Examination

Examination of the named insured under oath may be required in matters that relate to the loss. The insurance company may request these examinations more than once, but such requests must be reasonable. If multiple persons are examined, the company has the right to examine each individual separately.

5. Records

The named insured must produce any records related to the loss. The insurance company must be allowed to make copies and take extracts of them as often as it reasonably requests. Records include tax returns and bank microfilms of all related cancelled checks, but records are not limited to just these.

6. Damaged Property

Both damaged and undamaged property must be made available for the insurance company's inspection as often as reasonably necessary. It must also be allowed to take samples of the property and to inspect it.

7. Volunteer Payments

The named insured has the right to make payments, assume obligations, pay or offer rewards, or incur other expenses. However, unless the insurance company has given written approval for such actions, the named insured cannot expect any reimbursement. The only exception is that the insurance company will pay for the costs incurred to protect property as item 2. above describes.

8. Abandonment

The insurance company decides when and if it will take ownership of the named insured’s property. The named insured is therefore not permitted to abandon damaged property to the insurance company until the insurance company agrees in writing to accept it.

9. Cooperation

The named insured must cooperate with the insurance company. Any actions required of the named insured within this policy must be performed.

Valuation

1. Actual Cash Value

The valuation of covered property is subject to 2. Pair or Set and 3. Loss to Parts below.

The value of all covered property is its actual cash value at the time of loss. Actual cash is replacement cost new minus depreciation.

2. Pair or Set

The

value of a loss that involves damage or loss of one part of a pair or

set is based on a reasonable proportion of the value of the entire

pair or set. However, the loss of one part of a pair or set is not

considered a total loss.

Note: This recognizes that the value of the whole is greater than

the value of individual parts but that the remaining parts still have value as

separates.

|

|

3. Loss to Parts

The

value of a lost or damaged part of the property that consists of

several parts is the cost to repair or replace only the lost or damaged part.

How Much We Pay

1. Insurable Interest

The insurance

company does not pay more than the named insured's insurable interest in the

covered property at the time of loss.

2. Deductible

The insurance

company pays only the amount of loss that exceeds the deductible amount on the

schedule of coverages.

3. Loss Settlement

Terms

a. The insurance company pays the least of the following, subject to items 1., 2., 3., 5., 6., and 7. in this section:

- The amount determined based on the Valuation section

- Costs to repair, replace, or rebuild the damaged property. The material must be of like kind and quality or as similar as practicable.

- The limit

that applies to the damaged property.

b. Catastrophe Limit

This applies only if a catastrophe limit is entered on the schedule of coverages.

When a covered peril causes loss or damage at more than one premises that is listed on the schedule, the most paid in a single occurrence is the lowest of either of the following:

- The total of the limits for covered property at all locations where the loss occurred

- The catastrophe limit

Note: Whenever a catastrophe limit is entered it is very important to adjust it any time the other limits on the declarations are increased to prevent an inadvertent capping.

4. Coinsurance

This provision applies to only losses that occur to a production that is listed on the schedule of coverages.

The insurance company does not pay the full amount of any loss if the value, at the time of the loss, of all covered property (subject to coinsurance) multiplied by 80% exceeds the limit of insurance. The following are the steps the insurance company takes to determine the amount it pays:

Step 1: Determine the value of items, at the time of the loss, of all covered property for the production that is subject to coinsurance.

Step 2: Multiply Step 1 by the coinsurance

percentage of 80%.

Step 3. Divide the limit for the

covered property for that production that

is subject to coinsurance by the result determined in Step 2.

Note: Stop here if the result

is 1.00 or higher because no coinsurance penalty applies. Go to Step 4 only if

the result is less than 1.00.

Step 4. Multiply the total

amount of loss, prior to the application of a deductible, by the percentage

determined in Step 3.

Step 5. Subtract the applicable

deductible from Step 4.

The insurance

company does not pay more than the amount determined in Step 5. or the limit of

insurance, whichever is less. It does not pay any remaining part of the loss.

5. Insurance under More Than One Coverage

Two or more coverages in the coverage form may cover the same loss. In

that case, the insurance company does not pay more than the actual value of the

claim, loss, or damage sustained.

6. Insurance under

More Than One Policy

a. Proportional Share

The named insured may have other coverage subject to the same terms as this coverage form. In that case, this coverage form pays only its share of the covered loss. That share is the proportion that its limit of insurance bears to the limits of insurance on all insurance that covers on the same basis.

b. Excess Amount

There may be other coverage available to pay for the loss other than as described in item 5. a. above. In that case, this coverage form pays on an excess basis. It pays only the amount of covered loss that exceeds the amount due from the other coverage, whether it can be collected or not. Any payment is subject to the limit of insurance that applies.

Loss Payment

1. Loss Payment

Options

a. Our Options

The insurance company has four loss payment options

if a covered loss occurs.

- Pay the value of the

property that sustained loss or damage

- Pay the cost to

repair or replace the property that sustained loss or damage

- Rebuild, repair, or

replace the property with similar property, to the extent possible and it

must be accomplished within a reasonable period of time

- Take any part or all

of the property based on the value that has been agreed upon or determined

through appraisal.

b. Notice of Our Intent

to Rebuild, Repair, or Replace

The insurance company must notify the named insured

of its intent to rebuild, repair, or replace within 30 days of receiving a

properly completed proof of loss.

2. Your Losses

a. Adjustment and Payment of Loss

The insurance company adjusts all losses with and pays the named insured. The only exception is when a loss payee is on the policy.

b. Conditions for Payment of Loss

The insurance company pays a covered loss within 30 days after it receives a properly prepared proof of loss and the amount of loss is established. The amount of loss is determined either through a written agreement between the company and the named insured or after an appraisal award is filed with the company.

3. Property of Others

a. Adjustment and Payment of Loss to Property of Others

The insurance company has the option to adjust and pay losses that involve property of others to either the named insured on the property owner’s behalf or to the property owner.

b. We Do Not Have to Pay You if We Pay the Owner

The insurance company is not obligated to pay the named insured when it pays the property owner. In addition, if the property owner sues the named insured, the company has the option to defend the named insured in that suit.

Other Conditions

1. Appraisal

The insurance company and the insured may not always agree on a covered claim’s value. This condition provides one method to resolve disputed claims.

Either party can request an appraisal to

determine a disputed claim’s value. Once requested, the parties have 20 days to

obtain their own independent and competent appraisers and give their

appraiser's name to the other party. The two appraisers then have 15 days to

select a competent impartial umpire. If they cannot agree on an umpire within

that time period, either can request that a judge in the court of record

in the state where the property is located appoint one.

The appraisers then determine the claim’s

value. They submit any differences to the umpire. Once any two of the three

parties agree, the amount of loss is set.

Each party pays its own appraiser. Both parties

share the umpire’s cost and other expenses equally.

2. Benefit to Others

The insurance

provided does not directly or indirectly benefit any party that has custody of

the named insured's property.

3. Conformity with

Statute

Any condition

in this coverage form that conflicts with any applicable law is amended to

conform to that law.

4. Estates

a. Your Death

This

applies only when the named insured is an individual. When a named insured

dies, the person who has custody of the named insured's property is an insured

for that property until a qualified legal representative is appointed. Once the

named insured’s legal representative is named, that person but only

for the property covered under this policy.

b. Policy Period is not Extended

This

coverage does not extend past the policy’s expiration date.

5. Liberalization

A revision of this coverage form or an applicable endorsement that takes effect during the policy period or within six months of when this coverage takes effect may broaden coverage without an additional premium charge. In that case, the broadened coverage applies to this coverage.

6. Misrepresentation,

Concealment, or Fraud

This coverage

is void if any insured at any time willfully concealed or misrepresented a

material fact that relates to the insurance provided, the property covered, or

its interest in the property. It is also void if any insured engaged in fraud

or false swearing with respect to the insurance provided or the property

covered.

Note: The named insured must deal with the insurance company honestly. Its rights of recovery may be voided if it intentionally misrepresents or conceals a material fact or information. This means that the insurance is treated as simply having never existed versus a particular claim being denied.

7. Policy Period

Only covered

losses that occur during the policy period are paid.

8. Recoveries

Payment of the loss does not end the obligations of the named insured and the insurance company toward one another. Additional provisions apply if the insurance company pays a loss and the lost or damaged property is subsequently recovered or the parties responsible for the loss pay for it.

Either party that recovers property or payment must inform the other. Recovery expenses that either party incurs are reimbursed first. If the named insured keeps the recovered property, it must refund the amount of the claim the insurance company paid, unless the company agrees to a different amount. If the claim paid is less than the agreed loss due to applying a deductible or other limitation, any recovery is prorated between the named insured and the insurance company, based on the company's respective interest in the loss.

9. Restoration of

Limits

Payment of a

claim does not reduce the limit available for future claims.

10. Subrogation

The insurance company acquires the named insured's rights of recovery from third parties after it pays a loss. The named insured must help the company secure those rights. The insurance company is not obligated to pay the loss if the named insured hinders or impairs its rights of subrogation.

The named

insured has the right to agree in writing to waive recovery rights from any

party if it does so before a loss occurs.

11. Suit against Us

The insurance company cannot be sued by anyone for any coverage until all the terms of the coverage form have been met. Suits must be brought within two years after the insured first knew about a loss. If a state law invalidates this condition, any suit brought must comply with that law’s provisions and begin within the shortest period of time allowed by law.

Note: It is normal for a basic coverage form to be modified by mandatory state-specific endorsements that address issues that relate to that state.

12. Territorial

Limits

Covered property must be in the United States of America, its territories, and possessions, Canada, or Puerto Rico for coverage to apply.

ENDORSEMENTS

AAIS has not developed endorsements to use with Theatrical Property Coverage.

UNDERWRITING CONSIDERATIONS

Coverage applies to property that is not defined by where it is kept. It could be on the road, at a temporary storage location or in a theater. This means that the most important aspect of the coverage is the inventory of property that is assigned to a specific production. There should be one person in charge of maintaining the necessary inventories for each covered production.

Appropriate security and protection of the property is imperative but will change significantly based on the production, quality of props and accessibility of the property.

Prior loss information is important because it could indicate lack of control.

The method of transport is also important because in transit accidents could result in total loss of all property. The use of a carrier for hire could limit exposure under the policy.

Menu (click here to expand or to collapse)

Menu (click here to expand or to collapse)